taxing unrealized gains explained

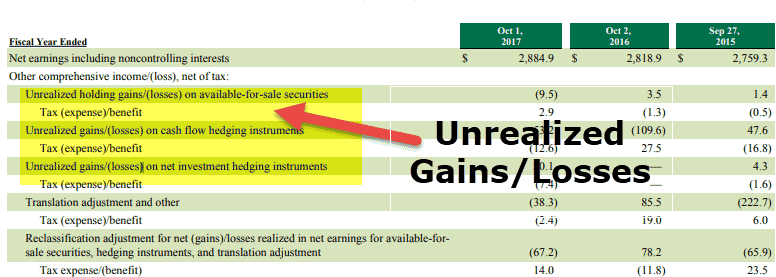

Since there is no tax on unrealized gains or losses these dont need to be reported in tax filings. An unrealized gain is a potential profit that exists on paperan increase in the value of an asset or investment you own but havent yet sold for cash.

An Overview Of Capital Gains Taxes Tax Foundation

The biggest tax bills would come up front charging a long-term cap gains rates on all unrealized monies for tradeable investments.

. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by Democrats as another step. Bidens proposal would do away with the step-up in basis. Unrealized capital gains are the main type of income for some very wealthy people who can defer paying income taxes on it for years allowing their wealth to grow much more.

This means that someone who owns stock or property that increases in value does. This is an important point from a tax perspective as a capital gain is taxed only. Without taxing unrealized gains at death the revenue.

Is a Wealth Tax on Unrealized Capital Gains the Final Straw. Realizations would fall so much that it would more than offset the revenue produced by the higher tax rate. Current Market Value Historical Value Unrealized GainUnrealized loss If the value obtained by this calculation.

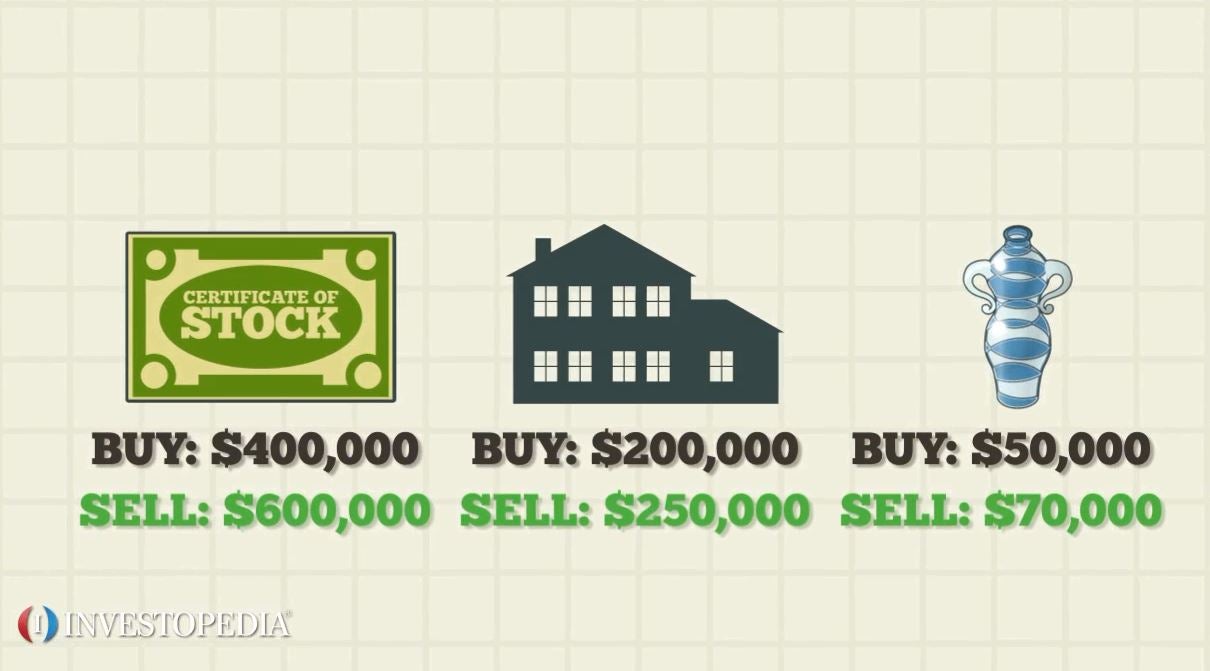

Understanding Blockchain and Bitcoin httpsbitly33hbAi5 Subscribe to our channel here so you do not miss our DAILY VIDEOS and pr. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. So an unrealized gain or loss is when the value of an asset has increased or decreased but you havent actually sold it yet.

The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized. We can simplify the formula for calculating unrealized gainloss as follows. President Bidens proposal to require roughly 700 US.

Unrealized gains and losses are paper gains or losses meaning that gains and losses are only real on paper. These are also known as paper profits or losses. For example if you buy a.

Lets say you bought some crypto at the start of a tax year and by the. Example of New Proposed Wealth Tax on Unrealized Capital Gains Explained. Currently the tax code stipulates that unrealized capital gains are not taxable income.

As such an assets unrealized appreciation would be taxed at transfer meaning the heir would get hit with a hefty. Payments could be spread out over five years.

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

The Unintended Consequences Of Taxing Unrealized Capital Gains

Unrealized Capital Gains Tax For Billionaires Explained

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Taxes Explained Investing Tax Efficiently Moneymade

Is A Wealth Tax On Unrealized Capital Gains The Last Straw

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19430294/Screen_Shot_2019_12_04_at_1.44.54_PM.png)

Joe Biden S Tax Plan Explained Vox

Biden To Include Minimum Tax On Billionaires In Budget Proposal The New York Times

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax Canada Explained

Capital Gains Definition Rules Taxes And Asset Types

Here S How Janet Yellen S Proposed Tax On Unrealised Capital Gains May Work Business Insider India

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Unrealized Gains And Losses Examples Accounting

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation